Desktop installer improvements

To streamline the install experience for Tableau Desktop for Windows, the four most common database drivers are now included as part of the setup process and are automatically installed by default. The following drivers are included:

- MySQL (version 5.3.4)

- Microsoft SQL Server (version 2008 R2)

- PostgreSQL (version 9.3.400)

- Amazon Redshift (version 1.2.1)

Note: Microsoft Visual C++ Redistributable is also automatically installed as a prerequisite for MySQL.

To view the list of drivers, or to clear the option to install these drivers, accept the license agreement on the installer page, and then clickCustomize.

You can clear the option to install the drivers in either the user interface or from the command line.

If you want to perform a quiet install for Tableau Desktop 9.3, use the installer (.exe) file. The installer package (.msi) is included as part of the installer file and can no longer be extracted separately.

For more information about how to perform a quiet install of Tableau Desktop, see Performing a Quiet Installation of Tableau desktop or Tableau Reader in the Tableau Knowledge Base.

Stay connected to Tableau Server or Tableau Online

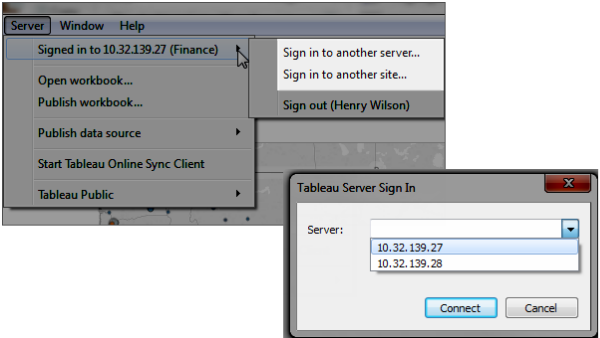

When you connect to Tableau Server or Tableau Online, Tableau Desktop saves each connection from session to session if you don't sign out. Next time you launch Tableau Desktop, you are signed in to your most recent server connection. You can also sign into different servers and easily switch between your available server and site connections.

For more information, see Quick Start: Stay Connected with Automatic Sign-In.

Forecasting improvements

Forecasting in Tableau Desktop has been improved in the following ways:

- You can now forecast values ordered by an integer dimension. Formerly it was only possible to forecast measures that are ordered by time. For more information, see Forecasting When No Date is in the View.

- Automatic selection of the best season length for a forecast has been improved. For more information, see the Seasonality section in How Forecasting Works in Tableau.

- Tableau forecasting will now skip null or missing values when estimating model parameters. However, the nulls remain in the series so the indexes of the values remain the same. For example, for a daily time series that is missing weekend days, the algorithm computes the model, potentially with parameters for a weekly cycle, but without using the missing values. But because the missing values are in the series, the cycle length is still seven days.Due to this change:

- Forecasting now supports irregular time series without zero fill. So no error will result if you do not select Fill in missing values with zeros in the Forecast Options dialog box.

- The Fill in missing values with zeros option is no longer selected by default in the Forecast Options dialog box.

New data source support for Tableau functions and aggregations

For Tableau 9.3, more functions and aggregations are available for more data sources:

- The PERCENTILE function and aggregation are now available for Cloudera Hive, Hortonworks Hadoop Hive, and EXASolution data sources.

- The MEDIAN function and aggregation are now available for Cloudera Hive, Hortonworks Hadoop Hive, and EXASolution data sources.

- Regular expression functions (beginning with REGEXP_) are now available for HP Vertica, Pivotal Greenplum, and Teradata (version 14.1 and above) data sources. See Additional Functions. In addition, REGEXP_MATCH is now supported for Impala 2.3.0 and higher in Cloudera Hadoop data sources.

- The SPLIT function is now supported for Impala 2.3.0 and higher in Cloudera Hadoop data sources. Split functionality in the Data source pane is also now supported for Impala 2.3.0 and higher in Cloudera Hadoop data sources. See Quick Start: Split a Field into Multiple Fields.

Add color to sheets in sorter view

To make it easier to identify or group worksheets, you can now add color to the sheet tabs in the sheet sorter.

Workbook updates to use published data source

When you publish a data source to Tableau Server or Tableau Online, the workbook you're publishing it from is updated to connect to the published data source. At the same time the local data source is closed. To continue using the local data source, clear the Update workbook to use the published data source check box in the Publish data source to Tableau Server dialog box.

If you click Undo after publishing a data source, Tableau will revert to using the local data source, but it will not "un-publish" the data source.

Tableau does not replace the local data source when you publish a cube (multidimensional) data source.

For more information, see Publish a Data Source.

Union your data

In your Tableau data source, you can now append rows of data from one table to another table thereby creating unions. If columns in the union do not align correctly, you can merge the columns whose names don't match. For more information, see Union Your Data.

Data grid enhancements

From the grid on the Data Source page, you can now do the following:

- See extract data and extract-only calculations, including data from the Web Data Connector

- Review data after applying extract filters and aggregating extracts

- Create groups and bins

- Join on pivot columns

- Join on merged columns

- See sheet and table name information for unioned tables

Zooming improvements for maps

Zooming in map views just got easier. You can now scroll to zoom in and out of a point on a map.

WMS Support for Web Mercator

Tableau now supports WMS servers that use Web Mercator. For more information, see Supported Spatial Reference Systems in the Use WMS Servers topic.

New default tool for maps

When you click and drag in a map view, you can now automatically select marks with the rectangular tool. This is a change in behavior to Tableau Desktop version 9.2, where clicking and dragging in a map view would automatically allow you to pan across the view instead.

View tools remain active

When you select a tool from the view toolbar (the pan tool, zoom area tool, radial tool, rectangular tool, or lasso tool), it remains active until you select to use another tool. The same is true if you use keyboard shortcuts to switch between tools. This is a change in behavior to Tableau Desktop version 9.2, where a tool would revert back to the default after one use.

The last tool you select will be saved with the workbook and available when you reopen it or publish it to the web.

Totals are no longer included in color encoding

Totals are no longer color encoded by default when you add them to the view.

To include totals in color encoding, click Color on the Marks card and then select Edit Colors. In the Edit Colors dialog box, select Include Totals.

| Default | Totals included in color encoding |

|  |

New Snowflake data connector

Use the Snowflake connector to connect to a Snowflake data warehouse. For more information, see Snowflake.

Data preview for Web Data Connectors

When you connect using a Web Data Connector, Tableau now opens on the Data Source page so that you can prepare your data (for example, change data types or hide columns) before you start your analysis.

Kerberos support for PostgreSQL and Teradata

Kerberos support has been added for PostgreSQL and Teradata connections. For more information, see PostgreSQL or Teradata. For information about configuring Tableau Server for Kerberos, see Kerberos in the Tableau Server Help.

OAuth support for Salesforce in Tableau Desktop

You can now use OAuth when you connect to Salesforce in Tableau Desktop. After you provide your Salesforce credentials and allow Tableau access to the data, Salesforce.com creates an OAuth access token that is used to connect to the data. Instead of having to embed your credentials in data sources or workbooks, you can use the access token.

Initial SQL support added to more data sources

Oracle, Pivotal Greenplum, and Microsoft SQL Server now support initial SQL statements.

Initial SQL parameter support

For data source connections that support initial SQL, you can now perform parameter substitution for a set of useful parameters, such as ServerUser and WorkbookName. For more information, see Run Initial SQL.