By Jackie, Researcher

Topic: Education

Area of discussion: Financial Accounting and Reporting

Chapter: Business Combinations – Consolidated Financial Statements

The objective of this posting is to share a worked accounting question which is related to business combinations and consolidated accounts. In this example, clear step-by-step calculations with explanations are provided on: how to calculate the percentage of shareholding, how to compute goodwill, how to incorporate fair value adjustments, how to remove unrealised profit in inventory, how to find group retained earnings, how to compute non-controlling interest and finally, how to prepare consolidated financial statements. I believe this illustration will greatly help students to understand this topic and indirectly provides a solid ground for exam purposes.

Workings with explanations:

1). Percentage of shareholding

The first thing that ought to be done is to find out how much proportion has been acquired by the holding company, if it is not a wholly owned subsidiary. This is crucial as the other proportion may be held by many different shareholders and that kind of ownership is called as non-controlling interest (NCI).

Then, the NCI will be 20%. Always bear in mind that the number of shares used in the calculation of percentage shareholding must consists of voting shares only (i.e. ordinary shares) and not preference shares.

2). Computation of goodwill

Compare the price paid to acquire Cahaya Bhd (i.e. Investments: Shares in group company), with the ‘value’ of Cahaya Bhd at the date it was acquired (i.e. the date of acquisition). Goodwill is the excess of the cost of the investment over the ‘value’ of the proportion of the net assets acquired. Please note that the net assets acquired can be measured either as fixed assets plus net current assets, or as share capital plus reserves.

It is also very important to make clear that pre-acquisition profits are used in the calculation of the goodwill figure (i.e. capitalised), while post-acquisition profits become part of the group profit. Besides, at the date of acquisition the fair values of Cahaya’s property, plant & equipment were agreed as RM150,000 greater than their book values. Thus, a revaluation reserve of RM150,000 will need to be created. Likewise, since the fair values adjustment occurred at the date of acquisition, it will be treated as pre-acquisition and so, it will become part of the goodwill figure. On the other hand, impairment loss has to be deducted from the goodwill figure and charged in the statement of comprehensive income.

3). Necessary adjustment for property, plant & equipment

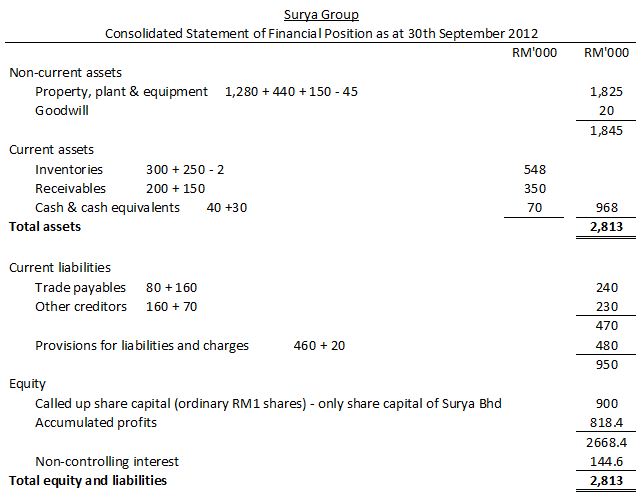

As Consolidated Statement of Financial Position was prepared at 30 September 2012, we have to sum up both property, plant & equipment owned by Surya Bhd and Cahaya Bhd as at that particular date too. In addition to that, we have to add revaluation surplus of RM150,000 inside that calculation as well, but additional care must be taken because the revaluation surplus was made on 1 October 2009 (i.e. 3 years ago). This mean that additional 3 years of accumulated depreciation has to be taken into account and since Cahaya Bhd has a 10% straight-line depreciation policy, the additional accumulated depreciation for the 3 years period will be RM150,000 x 10% x 3 years = RM45,000.

4). Unrealised profit in inventory

All of the group profit would only be realised, if the holding company which bought goods from subsidiary has subsequently sold all those goods to the third parties (i.e. the outsider). However, for this case, at the end of the year, the goods are not fully sold by the holding company as some goods are still remain in the inventory of Surya Bhd. Then, the amount of unrealised profit must be eliminated.

5). Group retained earnings / Accumulated profits

The retained earnings of the group will comprise the profits of Surya Bhd plus Surya Bhd’s share of profit of Cahaya Bhd which has been earned since acquisition. Adjustments for impairment loss, depreciation and unrealised profit have to be taken into account, if any.

6). Non-controlling interest to be recorded in Consolidated Statement of Comprehensive Income

The non-controlling interest is calculated as 20% of the profit for the year after tax of Cahaya Bhd. This equals: 20% of RM180,000 = RM36,000. We only need to record additional depreciation for one year instead of three because this is not Consolidated Statement of Financial Position. So, remember do not take the accumulated depreciation for 3 years. Meanwhile, unrealised profit needs to be eliminated according to its proportion (i.e 20%).

7). Non-controlling interest to be recorded in Consolidated Statement of Financial Position

Non-controlling interest will be entitled to 20% of the fair value of the company at the date of acquisition. Note: There is no need to divide reserves into pre- and post-acquisition as far as the non-controlling interest is concerned. Non-controlling interest is entitled to share in both pre- and post-acquisition profits. Unlike Consolidated Statement of Comprehensive Income, additional depreciation of 3 years needs to be recorded in Consolidated Statement of Financial Position. Meanwhile, the unrealised profits will have to be deducted according to its proportion (i.e 20%) as usual.

Answers:

Intra-group trading must be eliminated from the consolidated statement of comprehensive income. Therefore, intra-group sales of RM50,000 must be eliminated from both consolidated sales revenue and consolidated cost of sales figure. There are some intra-group goods sold that are still remain in the closing inventory. That unrealised profit must be removed, and this is usually done in practice by increasing the cost of sales figure. Impairment loss of RM8,000 and additional depreciation for one year have been included in the administrative expenses. Investment income is to be removed as it was fully came from dividend paid by Cahaya Bhd: 80% of RM50,000 = RM40,000. Any investment income shown in the consolidated statement of comprehensive income must only be from investments other than in a subsidiary.

Additional readings, related links and references:

This article explains how to prepare basic consolidated financial statements for a group with one subsidiary. It’s the second in a two-part series by the F1 examiner.

Basic rules for preparing a consolidated balance sheet. Good explanations on all treatments and adjustments. Formulas and which items need to be debited or credited are fully displayed here.

Another good exercise with detailed workings and clear explanations done by CIMA, which is good to be viewed by accounting students who are currently studying on this particular chapter.

Preparing simple consolidated financial statements

Preparation of group financial statements – ACCA

No comments:

Post a Comment