By Jackie, Researcher

Topic: Education

Area of discussion: Cost & Management Accounting

The objectives of this research are to find out which method is considered the best method to allocate indirect costs (i.e to generate relevant cost information for decision making purposes), the correct ways on how to calculate it (steps by steps guide is given below plus an additional real question taken from LCCI as an extra revision purposes), to explain what are the differences between activity-based costing and traditional absorption costing system and how to use a “quick check” method of which I designed myself (to check whether the computed answers are correct or not?).

Introduction

Generally, both methods are used to calculate the cost of production. There are no differences between these two methods in finding material costs and labour costs. Their major concern is how to allocate the overhead costs to the cost of production. Ideally, using Activity-Based Costing is better than Traditional Absorption Costing as it is more accurate, reasonable and appropriate. This is because Activity Based Costing system uses both volume-based and non-volume-based cost drivers, while Traditional Absorption Costing system uses only volume-based cost drivers. Examples of volume-based cost drivers include: units of output, direct labour hours and machine hours while examples of non-volume-based cost drivers include: numbers of production inspection, number of machine set-up, number of stock requisition and etc.

Let’s take a look at this example:

Based on the question above, single-stage traditional absorption costing system applies, whereby we need to total up all the overheads cost and then divide it by the total level of activity. For this question the level of activity will be the total number of machine hours. After dividing it, we will get the overheads cost per one unit of activity (i.e. production overhead absorption rate). Then, the final step is to allocate this rate to the products by multiplying it with the number of machine hours used by a particular product. See below.

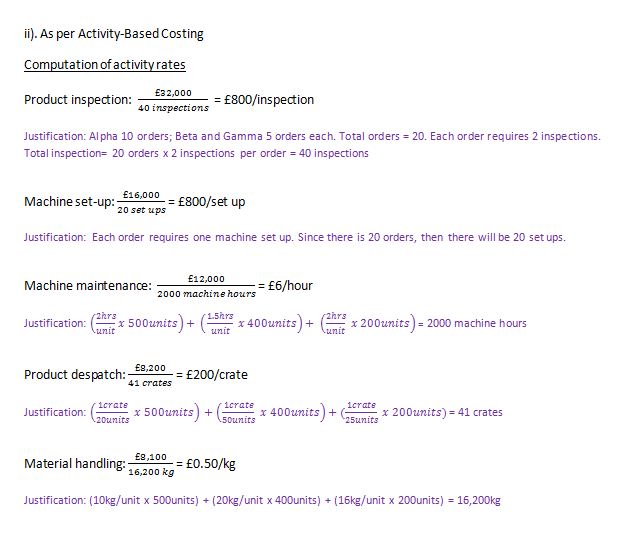

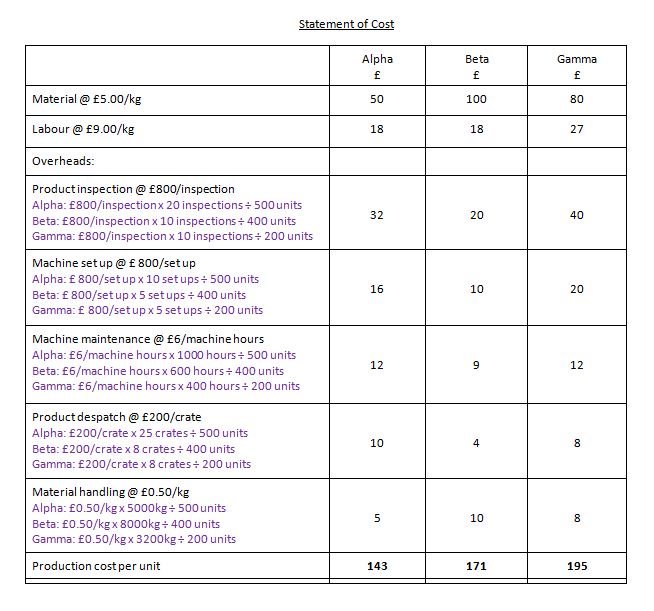

For Activity-Based Costing, since the separate cost activities are already given, then we only need to divide the cost of each activity with their respective cost drivers in order to find the activity rates. Cost driver is the factor that causes a change in an activity cost. For example: number of inspections and number of set ups. See below.

Then, the final step is to allocate those rates to products by multiplying them with the amount of cost drivers which will be used by them. For example, if product Alpha requires 20 inspections, then, 20 inspections x £800/inspection = £ 16,000 will be allocated to product Alpha. In order to find the product inspection overhead per unit, we have to further divide the amount by the Alpha’s total production output (units) which is 500 units. Then, £32 will be allocated to each unit of Alpha. Same method of calculation applies for the rest. See below.

A “quick check” method:

Although the cost of production per unit for each product is different in Traditional Absorption Costing and Activity-Based Costing, both methods will have the same total cost of production and because of this we can use this “quick check” method to check the answers.

References, additional readings and related links:

Gain an understanding of the basic concept of activity based costing

The basic concept of activity based costing

Activity Based Costing versus Traditional Costing

Activity Based Costing with worked example to compare with Traditional Costing

No comments:

Post a Comment