|

| http://www.industrialsupplymagazine.com/pages/Print-edition---JanFeb17_Hurtte.php |

We have received even more notifications from distributors who were suckered or nearly swindled out of their hard earned dough. Most of these scammers are pretty sophisticated, others not so. Either way, our informal study into the subject indicates scammers are costing distributors mega bucks.

We have had our fair share of those looking to spare others by sharing their horror stories:

"Watch out for those customer willing to accept full list price. In this day and age people can find competitive pricing instantly with a few clicks of the mouse. Why would an experienced purchasing agent not shop or a least haggle."

"Be wary if a customer calls in an order with a credit card and sends someone else to pick up the item. We have been hit with this one. A month later the credit card company informs us the charge is being disputed. The signatures don't match."

And an equally terrifying, yet different type of scam:

"We were annihilated by [ransom ware] last year. The bait was brilliantly constructed and we were incapable of discerning the difference between it and a real Microsoft windows fix."

While we're not able to reveal the companies represented here, we do appreciate their willingness to share their stories. Thanks to similar tales, River Heights Consulting decided to take our research a step further by creating a bogus distributor front and email address W.E.CoyoteDistribution@gmail.com.

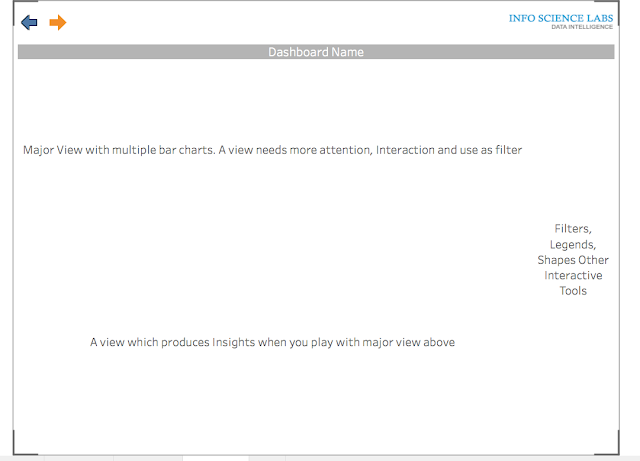

Here’s the logo:

In less than 24 hours the following scam email arrived and others continue to pour in: